Robotics and Automation in 2022 – Can They be a Useful Hedge to Recession?

December 8, 2022

By Yulin Wang, Technology Analyst, IDTechEx

Robotics and automation have significantly revolutionized how people work and live across a number of industries. With the increasing likelihood of a global economic recession in 2023, many industries are struggling with increasing manufacturing costs, such as labor and raw material costs, and maintaining their profit margins. The robotics and automation sector provides solutions to mitigate the issue by reducing operational costs and increasing production efficiency. As a result, IDTechEx believes that robots will be increasingly adopted to hedge against the upcoming recession. In this article, IDTechEx highlights the robot’s pivotal applications and benefits from its independent perspective on this crucial industry.

Collaborative Robots (Cobots) Will be in Their Prime Time within Ten Years

While industrial robots have been popular for many years, they bring some social-economic problems, such as concerns over manual labor replacement and high upfront costs. Cobots are introduced to solve these problems. So, what exactly is a cobot, and why are they expected to gain popularity? To understand this, IDTechEx summarizes a few key drivers.

Driver One – Low Capital Barrier and Fast Return on Investment (ROI)

Unlike traditional industrial robots that work in a space physically separate from human operators, cobots are designed to work side-by-side with humans in a ‘co-working’ space. In addition, cobots are typically smaller, slower, and cheaper than industrial robots to ensure a high safety level. Thanks to these features, many small and medium enterprises (SMEs) with a limited budget have started to adopt cobots in recent years. Meanwhile, the low, upfront cost also leads to a short payback time. According to IDTechEx’s research, the average payback time for a cobot is less than a year in several applications.

Driver Two – Reshoring and Increasing Demand for Productivity Upgrades for SMEs

Ever since the occurrence of COVID, global supply chain disruption has been a massive pain point across the globe. This has made many large companies aware of the weaknesses of the current business model where manufacturing is outsourced, and global logistics is heavily needed. As a result, many global companies have started to seek local suppliers to mitigate these issues. However, one issue with this is that many local suppliers are small, and their limited manufacturing capacity does not meet the demand of large companies. Therefore, many local suppliers have started seeking factory automation to boost their productivity.

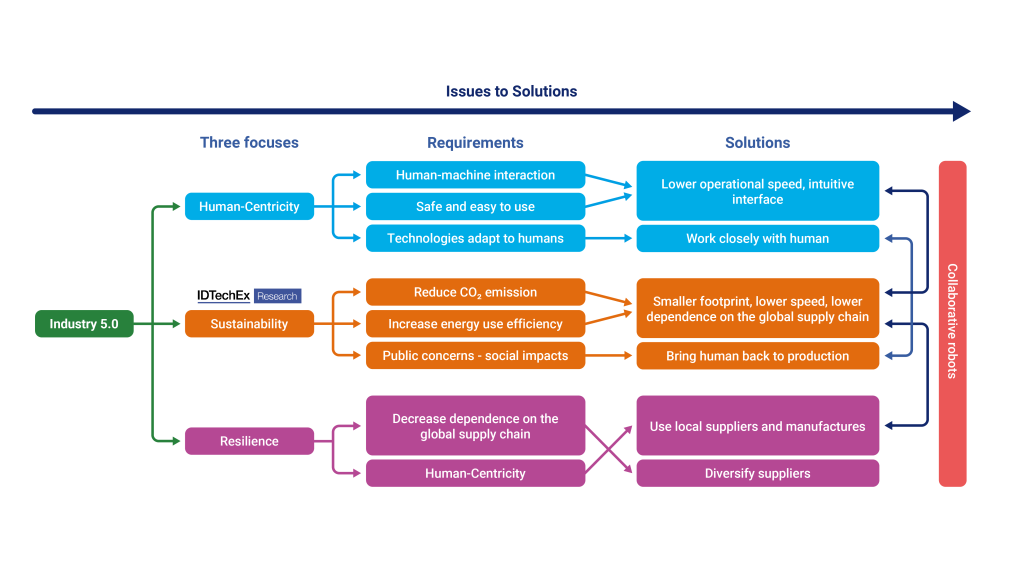

Driver Three – Calling to Bring Humans Back to Factories and Creating a Human-centric Working Environment

In 2020, the European Commission proposed its ‘Industry 5.0’ plan. Compared with the ‘Industry 4.0’ plan that has been discussed for around a decade, Industry 5.0 focuses more on human-robot collaboration and bringing people back to production lines. In Industry 4.0, human operators are required to adapt to machines, and the interaction between robots and human operators is limited. In Industry 5.0, the situation is reversed. One of the fundamental concepts of Industry 5.0 is the human-centric working environment where machines need to adapt to human operators.

Despite the drivers, cobots are still at their formative stage and the market share of cobots in industrial applications is less than 10% at this stage. Nevertheless, IDTechEx believes that the market will start to take off within two years thanks to the ‘smart factory’ proposals by leading automotive manufacturers, such as Audi. Industry 5.0 in 2030 is expected to add more momentum to the cobot industry.

IDTechEx believes that the market size of cobots will exceed US$100 billion by 2042. The increasing market in cobots also presents significant opportunities for safety sensors used in cobots, as cobots need a combination of sensors to enhance their safety. More details about collaborative robots and their impacts on Industry 5.0 can be found in IDTechEx’s latest research – “Collaborative Robots (Cobots) 2023-2043: Technologies, Players & Markets”.

Service Robots will Automate Many Daily Tasks

A service robot is a machine/robot that performs useful tasks, excluding industrial automation applications. As a broad definition, service robots can be utilized to automate a broad spectrum of industries, including logistics and delivery, cleaning and disinfection, socializing, agriculture, underwater exploration, food service, and more.

Driven by increasing labor costs, the trend for deglobalization, border closure, and the increasing value for money of robots, service robots have become more popular over the past decade. Compared with traditional industries where thousands of laborers are needed for repetitive tasks, service robots offer solutions to automate a significant number of dull tasks with higher efficiencies.

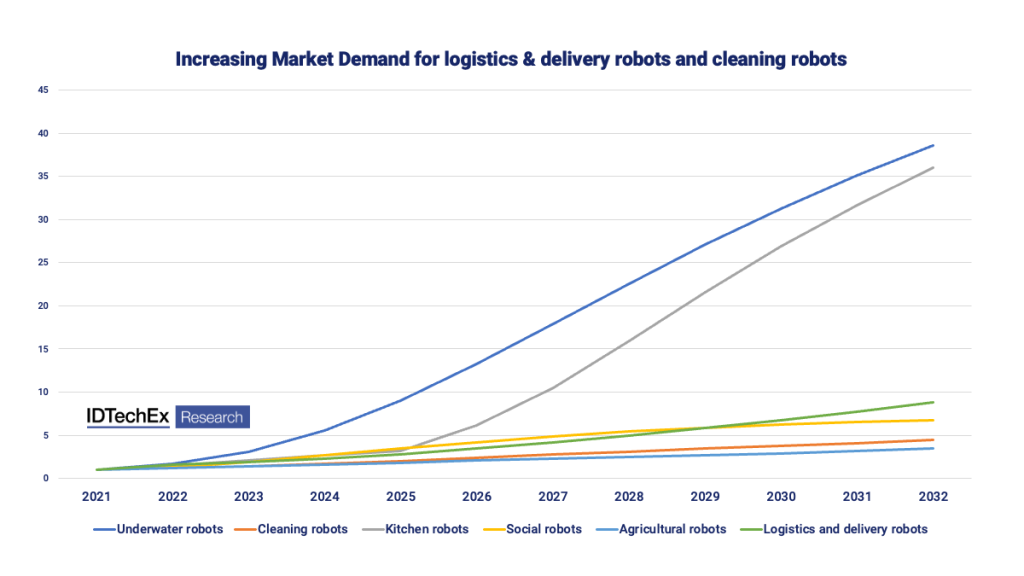

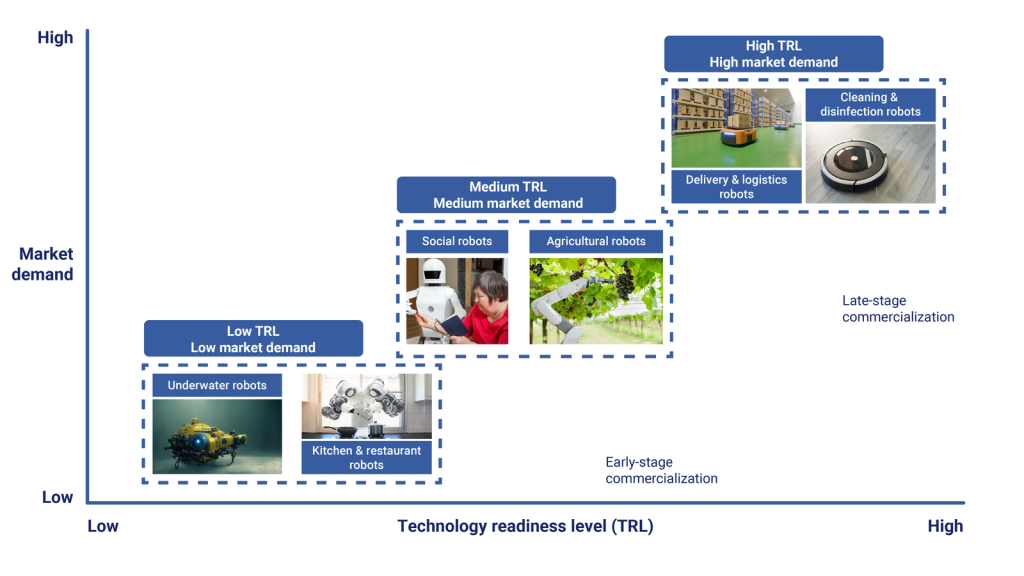

Although service robots can automate many industries, each type of robot presents a different technology readiness level (TRL) and addressable market. Among all the applications, delivery and logistics robots, along with cleaning and disinfection robots, are expected to lead the market in the foreseeable future thanks to their high TRL and large addressable markets. By contrast, social robots, kitchen & restaurant robots, agricultural robots, and underwater robots are still in their early commercialization stage because of regulations and high technical barriers.

However, IDTechEx sees enormous potential and a surge in the market size of these emerging applications with the easing of regulations and increasing technical robustness. For example, IDTechEx predicts an 8.8-fold increase in demand for logistics and delivery robots and a 6.8-fold increase for social robots by 2032 compared with 2021. More details about the forecast and why the market will grow like this have been explained in detail in IDTechEx’s latest research – “Service Robots 2022-2032: Technologies, Players & Markets”.

Drivers:

Many industries have used service robots, and it is worth noting that the stages of development commercialization are susceptible to several factors. These include technology readiness levels (TRLs) and addressable markets. For example, delivery and logistics robots, along with cleaning robots, have the highest TRL as they typically work in a well-controlled indoor environment. In contrast, underwater robots present low TRL because they work in harsh environments with low temperatures, low visibility, and limited GPS signal, among other challenges. Similarly, agricultural robots have low TRL as they need to tackle difficult terrain and unpredictable weather, which adds significant complexity to their sensory systems, design, and control.

During the past several years, COVID-19 has driven the demand for cleaning and disinfection robots and robotic waiters. As an example, there have been at least 50 more cleaning & disinfection robot manufacturers founded in 2021 compared with 2020. With the lingering impacts of COVID, IDTechEx believes that the unit sales of cleaning and disinfection robots will continue to grow at double-digit rates on average each year from 2022 to 2027.

Barriers: Regulations are a significant barrier slowing down the market uptake of social robots. The global pandemic has boosted the demand for social robots that enable people with conditions like autism to stay connected with their families or medical practitioners in times of social distancing. However, there are debates about how to treat social robots that are designed to interact with humans. Robots, by definition, are machines that should not have emotions. However, social robots are designed to mimic the emotions of their users. Therefore, there has been a debate about whether they are fundamentally designed to deceive people. Therefore, IDTechEx believes that a more considerable uptake in social robots will require further regulations around their deployment.

Autonomous Mobile Robots Will Experience 86-fold Growth in 20 Years

The warehousing mobile robotics industry has grown quickly in recent years, spurred by advances in robotics technology, autonomous navigation, and AI. It may efficiently and cost-effectively alleviate the labor shortage issues currently threatening the global logistics industry.

The most widely seen mobile robots in warehouses and manufacturing facilities include Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), grid-based Automated Guided Carts, and mobile case-picking robots. Between 2019 and 2021, the market size of AGVs, AMRs, and grid-based AGCs increased by 21%, 42%, and 70%, respectively. The transition to a post-pandemic world means many companies have started to adopt mobile robots in their warehouses. This is driven by the flexibility and scalability that mobile robots provide and the shortage of labor resources.

Independent autonomy will be a crucial factor impacting the market trends as it determines the overall level of flexibility and scalability of mobile robots. According to IDTechEx Research, AMRs, without the need for navigation-supporting infrastructure, will reach the largest market size in 20 years, 86 times larger than its size in 2021. While the infrastructure-dependent AGVs and grid-based AGVs will have smaller increases in the market size over the same period.

The decrease in the market value of AGVs in the next decade is attributed to the competition with AMRs, as AMRs will gradually replace AGVs in many logistic operations and thus reduce the AGV market share with a shorter system installation time and quicker return on investment (ROI). However, since using navigation infrastructure enables more reliable and safer material transportation with the current technologies, AGVs and grid-based AGCs will still have larger market shares than AMRs in the short term.

Last-mile Delivery Robots:

Outside of mobile robots in warehouses, on-demand last-mile delivery robot companies have also received tremendous investment in recent years. For example, Nuro, a market leader in developing autonomous delivery vans, has raised over US$2.1 billion to date. The products in the autonomous last-mile delivery market can be categorized into three types – autonomous delivery vans, sidewalk delivery robots, and autonomous delivery drones. Autonomous last-mile delivery is an attractive but emerging market now – most companies are small start-ups, and their products have not been commercialized yet.

The biggest challenge for market growth in the following years will be regulatory restrictions. In 2021, only a few market leaders were legally approved to run their services and products in restricted areas. Though perhaps with capable technology and products, most last-mile delivery companies cannot validate their business models because of regulatory barriers. However, some countries have seen deregulations and trial commercialization led by governments or authorities over the past five years. IDTechEx estimates that large-scale deregulations will happen in three to four years, starting in high-income regions such as Europe and the USA, resulting in market take-off for autonomous last-mile delivery.

The rapid growth indicates that autonomous last-mile delivery is an emerging but up-and-coming, market. The sidewalk delivery robot market is forecast to have the quickest growth, with a CAGR of 36% between now and 2042. On the other hand, autonomous delivery vans are expected to have the largest market share, occupying 71% of the autonomous last-mile delivery market. In contrast, the market growth of autonomous delivery drones will be slow, primarily because of more regulatory and technological challenges than in the ground-based vehicle delivery market. IDTechEx’s latest research, “Mobile Robotics in Logistics, Warehousing and Delivery 2022-2042”, provides more details on the development of this market.

Key Summary of Robotics in 2022 – Takeaways:

The increasing likelihood of a recession and increasing costs (e.g. labor, raw materials, and logistics) have driven many companies, from global corporates to SMEs, to adopt collaborative robots to increase productivity. The short payback time (on average less than a year for many applications) and low capital cost (usually <US$40,000 per cobot) make them more economical for many companies with low budgets.

Government and large companies’ proposals are driving the increase of cobots. Proposals like ‘Smart Factory 2025’ by Audi and ‘Industry 5.0 in 2030’ by the European Commission are driving the market increase in cobots, especially within the next five to ten years. The increasing adoption of cobots also requires a higher level of safety, such as force and torque sensors, cameras, and many others.

Service robots have experienced substantial growth over the past two years because of COVID-19, and the economic benefits of many service robots have proven significant. IDTechEx believes that the service robots market will continue to grow.

AGVs and AMRs have rapidly increased over the past two years. With the easing of regulations and improvements in technologies, AMRs are expected to take over AGVs in the long future, although AGVs will remain dominant in the short term. To see the full IDTechEx robotics and automation research portfolio, including downloadable sample pages for all reports, please visit www.IDTechEx.com/Research/robotics.