Modularity in Production Technology: Just How Granular Do You Want to Go?

March 25, 2020

Machine and plant manufacturers adopting consistent modular approaches are often particularly successful. This article draws conclusions from the experiences of mechanical engineering customers of the HARTING Technology Group and illustrates how they can make the modularization of their products as efficient as possible. In these concepts, interfaces play a central role in these concepts.

The principle of modularity is best explained by the Lego building blocks. Innumerable objects can be created from a few basic bricks and defined connecting elements. This approach has also become established in industry for products featuring a far greater degree of complexity and variability: The platform strategy of the automotive industry is a typical example, according to which not only engines, transmissions and driving axles, but entire chassis are used as scalable modules for cars of different models, types and even brands. Also in the industrial control and drive technology area, systems such as PLC, IPC, HMI and drive components can be customized from individual “slices” or several remote I/O blocks and customized to suit the machine or plant to be automated. They can be expanded or modified in their further use without entailing any major input.

It can be argued that modularization of complex, industrially manufactured products can often only prove successful, both in technical and economic terms, given the fact that they are produced by the thousands (industrial controls), or even millions (automotive) of times over. But can a modularization approach also prove successful if at best only a few hundred machines of one type are turned out per year?

The answer must be yes. There is currently no alternative to modularization in mechanical engineering: “Standardization and modularization are aimed at a portfolio with less variance and complexity and an overall lower cost level, without reducing the breadth and individuality of the product range,“ as the VDMA states ((1) Future prospects for German mechanical engineering. VDMA, McKinsey 2014 / p. 59).

In order to better understand the meaning of this statement, a number of typical market demands and requirements in the manufacturing systems market will be presented here:

- A high degree of variability in production systems is called for, enabling the manufacture of a wider range of products even in small to medium unit volumes (keywords “industrial production of individual products”, “Industry 4.0”). In order to achieve this, the systems must be scalable and offer options for subsequent expansion in terms of capacity and output. While the main focus used to be on net productivity, mechanical engineering customers are now paying more attention to variability and expandability. In other words, it is not “highly sophisticated” systems for the production of components in high volumes that are in demand, but rather systems with which different products can be flexibly manufactured in small to medium volumes. ((2) Production Systems 2020. Roland Berger / 2011)

- The competition in mechanical engineering is forcing the OEMs of production systems to expand their business models. In today’s B2B market it no longer suffices to merely develop good products, sell them to operators and then wait for service and maintenance orders! TCO models for the profitability of investments, which were often used in the past, are more and more frequently extended by LCC models (LCC = Life Cycle Costs). This allows new business concepts, including maintenance, service, retrofit services (e.g. “predictive maintenance”) to be offered very transparently. It is easier for machine builders to convince users that the extended offering in connection with the life cycle of a plant are more advantageous. ((3) M. Bode, F. Bünting, K. Geißdörfer “Rechenbuch der Lebenszykluskosten”) The rising demand for subscription models on the customer side (“Pay per Use”, “Pay per Month”, “Pay per Unit” etc.) confirms this general, overarching trend. In terms of OEMs, it also makes economic sense to turn to benefit- and service-oriented models. While the average margin in the new machine business stood at 5.4% in 2018, this margin was many times higher in the service business at over 40%. ((4) Sector report “Mechanical engineering in Germany”, Commerzbank). What is more, demand for service is far less cycle-dependent than demand for machines!

- Especially in the case of expensive capital goods, it is often much more cost efficient for users to expand existing machines or to renew individual units or subsystems than to invest in an entirely new acquisition.

- In some customer sectors of the mechanical engineering industry there is a widespread expectation that machine modules and subsystems from different suppliers can be combined into a coherent production line without any additional effort – without any incurring, any technical or economic disadvantages.

All these demands and requirements can only be reconciled very efficiently, both technically and economically, if the production systems are consistently modularised and networked and offered as “smart” systems in various expansion stages. Citing specific figures, ID-Consulting, Munich, recently proved in its study ((5) “Modularization Study 2018/2019”) that modularization in mechanical engineering is an above-average successful strategy: Modularization of products drives corporate success.

Based on experience with HARTING customers, OEMs should first answer the following general questions positively when deciding on the pros and cons of modular approaches:

- The total estimated input and expenditure for a new, consistently modular product group or family will at a maximum be so high that it can be plausibly introduced within the time frame usual for the industry and assuming worst-case market development;

- The technical challenges of the planned division of the machine or plant into individual modules with transitions and interfaces should be assessed as generally feasible by all the protagonists involved (mechanical, electrical, safety engineering);

- All operational functions involved in the future service delivery process – development & design, project planning & sales, production & assembly, documentation, service & after-sales services, supply chain & marketing communication – should be prepared to attune and align their working methods with the modular concept of the machines and to “live” these methods both in-house and at the customer’s premises.

To what extent should a machine or plant be divided into modules and what is the general procedure to be followed? The real genius of LEGO bricks does not reside in the bricks themselves, but in their interconnections. These determine the possible granularity of the division, but also represent the limiting factor for the connection of building blocks. The situation is similar when regarding the interfaces of individual modules of a machine or system: The interfaces ensure the coherent and expedient “joining together”. At the same time, they guarantee the flawless and proper functioning of a production system, a single compact machine as well as of an entire production line. Consequently, the core question of modularization is: How do you delineate the components of a “complete system”?

In defining the boundaries between the electrical and electromechanical power, signal, data and communication interfaces, HARTING recommends the following procedure:

- To begin with, the basic, initial system should be considered in terms of its functions: Key functions, which reflect the core competence of the OEM; basic functions (e.g. carrier or transport systems), which extend across the entire system, and add-on or auxiliary functions, which are more in line with the general state of the art and are of secondary importance for the OEM. A certain amount of over-engineering in the machine modules, in which the proprietary core competencies are bundled, is always an advantage and therefore also recommended;

- Subsequently, the functions should be summarized in modules – but only as granularly as necessary; in this context, all aspects of the possible optimization effects and the necessary equipment variance – both on the manufacturer and on the user side – should be factored in. It is also important to include as many stages of service provision along the machine life cycle and/or country-specific features of customer requirements as possible.

- In the following, for all elements of the machine that cannot be further “separated” – sensors, actuators, HMI, drives etc. – that require electrical / electronic power, signal or data connections, …

- the functional relevance for the respective newly defined machine module is assessed and best displayed graphically;

- assigned to a corresponding layer in the sense of the “typical” automation pyramid;

- all necessary interfaces for the connection of individual elements are assigned to the respective machine modules and listed.

The result is a matrix view with all modules of the future system. The hierarchical arrangement of the elements with associated interfaces including relevance for one or more machine modules is also visible.

The advantage of such an approach is the fact that it provides a basis for the evaluation of feasibility, technical risks and the required design of interfaces. Furthermore, transparency is gained by weighting the importance of the modules for the future system. Based on the list all fractions involved as well as further specifications and steps for module and process development can be derived.

The matrix view also helps in deciding to what extent the control of a modular machine or plant should be designed centrally or decentrally. Our observations demonstrate that:

- systems with a high degree of equipment variability in their key functions and a large spatial extension tend to be consistently equipped with decentralized I/O systems;

- combined structures are chosen for smaller, highly variable systems: in these systems, the control of key and basic functions is centralised; additional functions are controlled either centrally (simple functions) or decentrally (via complex interfaces), depending on their complexity;

- in the case of smaller systems and/or simple systems with low variability, a purely central control solution is technically simpler and more cost efficient.

When deciding on a structure, it should be noted that central systems generally entail lower costs for components or materials. By contrast, however, this increases the costs and resources required for both production and installation at the end customer. Enhancements and retrofits can also be more time-consuming and cost-intensive, while the same applies to service and maintenance.

A positive aspect from the OEM and end-user perspective is the fact that all modern control, drive and HMI systems enable the complete separation of the physical level from the logical levels. This applies both to particularly fast and precise sequences as well as to highly sensitive safety-relevant or interlinked systems. The (virtually) absolute freedom afforded by the modularization of production systems is decisively characterized and influenced by the interfaces. The HARTING Technology Group provides solutions and products for all types of power, signal or data interfaces that:

- can always be designed to meet the necessary requirements (electrical, EMC properties) of the transmission path in a cost-optimized manner;

- can be scaled incrementally both in the technical parameters and in terms of size and number on each machine module;

- are able to meet different requirements with regard to contacting, assembly and protection type as well as the respective materials and can integrate alternative transmission media such as fiber optics and compressed air.

Conclusion

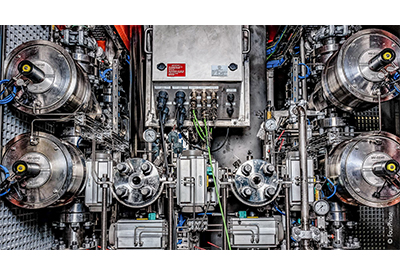

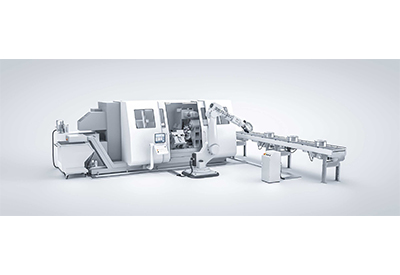

Consistent modularization based on the targeted optimization of all costs and service provision processes throughout the entire life cycle (LCC model) enable OEMs to manufacture machines according to a modular design principle – entailing significantly lower costs and time expenditure. At the same time, this strategy increases the scope for customized configurations. Users also stand to benefit from modularization, as they receive a cost and demand optimized machine that is designed transparently at the same time. HARTING provides solutions for all interfaces required in modern control, drive, HMI and communication technologies for production systems in order to implement modularization without functional restrictions. HARTING has been demonstrating this impressively and in actual practice for years, both in the plants of its HARTING Applied Technologies machine building subsidiary, and in HARTING’s Smart Factory “HAII4YOU” pilot and demonstration plant, which covers such innovative application fields as digital twin and AI intelligence by way of basic parameterizable analysis functions, the visualization of selected machine parameters and safe access to the machine from outside.

For more information, visit www.harting.ca.